THE MARKET SHARE OF LIC OF INDIA

| FINANCIAL YEAR | FPI | NOP |

| 2016-2017 | 71.07 | 76.09 |

| 2015-2016 | 70.44 | 76.84 |

| 2014-2015 | 69.21 | 77.85 |

| 2013-2014 | 75.33 | 84.44 |

| 2012-2013 | 71.25 | 83.24 |

If investment is the only purpose never INVEST in insurance plan.You need to understand the concept of insurance before buying insurance Plan.BUY insurance plan for risk cover along with saving.

Anything that can be purchased by money is a Commodity.

To purchase Life Insurance, 3-things are necessary

1.Money (it includes Capacity to pay future premium too)

2.Perfect Good Health

3.No Moral Hazard

Going by the above points, a Life Insurance Policy is NOT to be treated as a Commodity.

INSURANCE IS SUBJECT MATTER OF SOLICITATION

Insurance isn't a ready-made standard product like say, a bar of chocolate, that can be sold outright, it has to be discussed, understood. The right offering suited to your specific needs and requirements has to be considered taking into accounts, the terms, conditions and exclusions. Companies can only "offer to sell" it.Insurance becomes a product that you-the-customer must evaluate carefully after you have understood all its features, rules, conditions and exclusions. The onus of buying an insurance policy with its terms lies with the customer solely.If it is still not clear please ask the real meaning of this word to family of late music director Aadesh Srivastva, Michael Jackson,Bismillah Khan,Bhagwan Dada and Meena Kumari.Many of them left behind nothing but burden of huge loans taken during their last days sickness as well as loan taken for business.

When we are approached by insurance people we refuse, saying

1.I have sufficient insurance

2.My office had covered me under group mediclaim

3.Why I should spend this much money on Insurance

4.I don’t need insurance

5.Presently I don’t have money, we will do next year and many more.

When situation arrives, it never give alarm or sufficient time to take care of need.

Who needs insurance?

Do you think a person who becomes permanently disabled, needs insurance?

Does a dead person needs it ?

A person who just had a heart attack and spend 5,00,000 to do a bypass, needs it?

Can a person buy life insurance one day before his death?

Can these people buy it ?

No.

Life insurance must be bought when one does not need it. When one wants it one can not buy it . one can only buy it when he is healthy. One buys life insurance with his health and pay it with his money. If one cannot pass medical examination he cannot buy life insurance even if one has money.

The reason why you should buy insurance from LIC OF INDIA:

1 . Section 37 in The Life

Insurance Corporation Act, 1956 37. Policies to be guaranteed by Central Government.—The sums

assured by all policies issued by the Corporation including any bonuses

declared in respect thereof and, subject to the provisions contained in section

14 the amounts assured by all policies issued by any insurer the liabilities

under which have vested in the Corporation under this Act, and all bonuses

declared in respect thereof, whether before or after the appointed day, shall

be guaranteed as to payment in cash by the Central Government.

2. Huge customer base: LIC OF INDIA has customer base of Individual Policies 29.04 crore with Sum

Assured 40,57,567 crore and Group Policies(lives) 11.46 crore with Sum

assured 11,07,659.78.

3. Branch office network: Organizational

Structure and Human Resources as on 31.03.2017 Zonal Offices 8 ,Divisional Offices 113,

Branch Offices 2048,Satellite, Offices

1408, Mini

Offices 1238,Employees 1,15,394 ,Agents 11,31,181 Agency

network and other office of empowered agents and empowered Development Officers

4. LIC

OF INDIA: operating expense ratio: is the ration of operating expenses to the

premium underwritten by life insurers. The operating expense ration LIC

OF INDIA is 9.64% and private companies is 14.57% as per the IRDA report

2016-2017.

5. Profit

after tax and dividend payout : There are 18 companies reported profit afte tax

of 7727 .89 crore . LIC OF INDIA reported profit after tax of Rs 2231.74 crore .

For the year 2016-17, LIC paid Rs 2200.33 crore as dividend to shareholder i.e.

Government of India. Four private life insurers paid dividends during the

financial year 2016-17. HDFC Standard Life paid Rs 219.74 crore ICICI Prudential paid Rs 552.27 crore (`1202.99

crore in 2015-16), Max Life Rs140.07 and SBI Life paid `150 crore (`120 crore

in 2015-16).

6. Claim ratio: CLAIM

SETTLEMENT PERFORMANCE 2016-17 Total Number of Claims settled

215.58 lakhs. Total amount of Claims paid (including Micro Insurance and

P&GS) 1,12,700.41 crore. Percentage of Maturity claims settled 98.34% Percentage

of Death Claims settled 99.63%

7. Information

Technology :LIC has been a pioneer in using information technology for

enhancing the quality of its service to customers. Being the largest insurer in

India, LIC has always explored all the avenues that technology offers to

provide the best of services to its valued customers and other stakeholders.

8. Customer Centric Initiatives:

(A ) Offline payment

channels:

National Automated

Clearing House (NACH) This

facility, introduced in LIC

with effect from 8th November 2016, is a migration from the

existing ECS platform

of RBI. NACH clearing

is available Pan India and performs on the NPCI platform

of core banking.

Through NACH premium can be collected for ULIP and Health

Insurance (HI)

policies also.

Electronic Bill Presentation and Payment

(EBPP): Premium can be paid

through Corporation

Bank, CitiBank, HDFC Bank, ICICI Bank, Federal Bank, Axis Bank, LIC Credit Cards

and through Service Providers – Bill Desk and Tech

Process which cover

almost all other banks throughout the country. Premium can be paid through Credit

Card also availing this facility.

ATM: Banks can collect premium through ATMs also.

At present Corporation Bank, Axis Bank and

ICICI Bank have enabled this facility.Premium collection

facility for all (excluding ULIP & Health Insurance) in-force policies other than

Monthly Mode and Salary Savings Scheme is available under EBPP, and through ATM.

E Receipts are sent to the registered email-id of customers.

B) Online Payment

Channels:

1.Customers’ Portal

Payment Gateway: Premium

can be paid online on LIC Website, www.licindia.in with the help of Net Banking Facility, E

Wallets, Credit and Debit cards,

UPI/BHIM App. Conditions apply for card transactions.

2. Premium Collection

through Banks:

· Corporation Bank: Premium can be paid at any

bank branch or Extension Counter of

Corporation Bank in cash or cheques drawn on Corporation Bank.

Axis Bank: Premium can be paid at any bank

branch or Extension Counter of Axis Bank

in cash or cheques drawn on Axis Bank.

· City Union Bank: Premium can be paid at any

bank branch or Extension Counter of

City Union Bank in cash or cheques drawn on City Union Bank.Premium

collection for ULIP and Health Insurance Policies is not yet enabled through the

cash counters of the Banks.

( C) Premium collection

through Franchisees: The following Franchisees are approved to

collect renewal premium:·

a. APOnline

: a digital gateway for the Government of Andhra Pradesh and Telangana.

(websitewww.aponline.gov.in).

b. MPOnline:

a digital gateway for the Government of Andhra Pradesh. website

www.MPonline.gov.in)

c. SuvidhaaInfoserve

Pvt. Ltd. :It has more than 30000 collection centers pan India for

bill collection. Toll Free helpline number :9223225225

d. CSC Centers

through CSC e-Governance Service India Ltd:The Common Services

Center(CSC) Scheme is a part of the National e- Governance Plan (NeGP).

There are more than 1.25 lac CSC centers throughout the country out of

which approx 6000 have been activated for LIC Premium collection. Other collection

centers also are gradually being enabled for premium collection. Premium

can be collected only in CASH upto a maximum limit of Rs ·50000.00 in a single transaction Valid Receipts are

issued by the Collection Centres instantly.·No service charges are required to be paid to the collection

centre to ·avail this facility by the policy holders. Premium

collection for ULIP Policies is not yet enabled through the Collection Centres of

Franchisees.

e. Payment through

Paytm also is initiated by

LIC OF INIDA . You can now pay your premium through PAYTM too.

(D) Premium

collection through Senior Business Associates (SBA):Selected Development officers

called SBA are authorized to collect the premium both in Cash and Cheque online

and issue receipt instantly. Premium can be collected or conventional, ULIP

and Health Insurance policies. At present approximately 111 SBAs and 82 ASBAs

(Aspiring SBAs) are enabled to collect premium. Their collection Centres are

referred to as “Life Plus”.

( E) Premium collection through Empowered Agents: In tune with the increasing customer expectation

for more conveniences in servicing, the Corporation has empowered selected

Agents to collect the renewal premium through their collection Centres

called as “Premium Point”. At present, there are approximately 33,187

authorized Agents across the country who can collect the premium (including

ULIP and HI Policies) in CASH or CHEQUE and issue a valid receipt instantly.

( F) Premium collection through Retired Employees: Selected retired LIC Employees are also

authorized to collect the premium online and issue receipt instantly. At present

more than 263 Retired Employees are authorized across the country who can

collect premium for all policies.

(G) Premium

collection through LICAs (LIC Associates): LICAs are also authorized to collect

premium online and issue receipt instantly. At present more than 33 LICAs are

authorized across the country who can collect premium for all policies.

(H) LIC Mobile Application :Premium can be paid online using LIC Mobile application on Windows

and Android phones

( I). Payment

of premiums at POS machines : Renewal premium can be paid by policyholders by

swiping debit and credit cards at POS machines installed at selected Branches and

Premium Points of authorized Merchants .

LICHELP: The initiative of

LICHELP has gained popularity in recent times. The policyholders need to send SMS by keying

“LICHELP <policy no> to “9222492224”. An acknowledgement. SMS with a reference

number will be received by the policyholder and Customer Zone employee will contact

the customer for resolution of complaint/query. At each stage of complaint resolution,

the policyholder will be updated through SMS/e-mail.

Customer Zones: Customer Zones have

been conceptualized as a “one stop resolution” for all servicing needs of Phone-in

& Walk-in customers, with special emphasis on” Quality Experience”or the customer.

Presently 73 Customer Zones are Operational.

Customers contact these offices

from 8.00 a.m. to 8.00 p.m. on Monday to Friday and from 10.00 a.m to 6.00 p.m on

Saturday.

LIC’s e-Services LIC’s e-Services was

inaugurated on 1st Feb.2016 wherein we are providing Basic as well as Premier

Services as specified in the Revised Guidelines dated 29th May 2015, issued by IRDAI in

this regard. Basic services as mandated by IRDAI such as Policy status, Bonus status,

loan status, Claims status etc will be available to the customers registered on LIC’s

e-Services.Premier services such as premium due calendar, online premium payment

facilitation, premium history, claim history etc will also be available to the registered

customers.

Help us to serve you

better: Provision has been

made on Portal for the policyholders to provide contact details through “Help us to

serve you better” w.e.f. 1st Sept.2016. Through this option, the policyholder can

provide his mobile number & e-mail id details which will be used by LIC or further

communication with him/her. This initiative helps in faster settlement of claims. Claims Dispute Redressal

Committee (CDRC): The Corporation

pioneered the initiative of introducing an internal review mechanism to give an opportunity to

the claimant to appeal further, when a claim is repudiated by the Divisional Office. If

the claim is repudiated, the claimant is explicitly informed about the rounds of repudiation

and that he may prefer his / her appeal to Zonal Office Claims Disputes Redressal

Committee (ZO CDRC). ZO CDRC consists of senior officials of the Zonal Office and a

retired District or High Court Judge. Such Committees are functioning in all our

eight Zonal Offices.In case the claimant

is not satisfied with the decision of ZO CDRC and the net claim amount exceeds the

amount stipulated for final decision by ZO CDRC, the claimant may refer his / her

appeal to Central Office Claims Disputes Redressal Committee (CO CDRC) for further

review. CO CDRC consists of senior officials of the Central Office and retired High Court

judge. (Retired District or High Court judges are inducted in the Committees to bring in

transparency in the process of review vis-à-vis the claimant.)

Grievance Redressal

Machinery Policyholders'

Grievance Redressal Officers have been designated in all the offices of the Corporation, who

can be approached by policyholders for redressal of their grievances, on any day

but particularly on every Monday between 2.30 p.m. and 4.30 p.m. without prior

appointment. Central Office -

Executive Director (CRM) - for conventional policies Executive Director

(Health) - for health insurance policies executive Director

(P&GS) - for Group Insurance policies Executive Director

(Micro) - for Micro Insurance policies.Executive Director

(Marketing) Executive Director (

NB & Re) All Zonal Offices -

Regional Manager (CRM) - for conventional policies Regional Manager

(P&GS) - for Group insurance policies. All Divisional Offices

- Manager (CRM) All Branch Offices - Chief Manager / Sr./

Branch Manager

Life insurance provides peace of mind.

In a circus two persons jumping in the air and holding each others hand. Have they fallen ? No. Then why there is a net beneath to hold them . It is for the peace of mind. When one buys a new car how many tyre he gets? A car runs on four tyres but he gets five tyres . Why? It is for peace of mind. We all have inverter (power back up) at home .Why? It is for peace of mind. Insurance is for peace of mind.

The Concept of Insurance:

a)BREAD EARNER CONCEPT :

You give Rs.500/-If you are going outstation for 1 DAY

You give Rs.3,500/- If you are going outstation for 1 WEEK

You give Rs.15000/- If you are going outstation for 1 MONTH

You give Rs.180000/- If you are going outstation for 1 YEAR

How much You will give When you leave the World Forever?

We may die but not our responsibility.

b)HUMAN LIFE CONCEPT:

All insurance company has online human life value calculator you can calculate the same. Human Beings are income-generating assets: Manual labour, professional skills, business acumen etc are assets of an individual and he earns money (livelihood) through it. Death can snatch away this asset: Due to the untimely death of an individual there is loss to the dependents of the deceased individual. Insurance is necessary to help those dependent on this asset: Insurance help those who are dependent on the income of the deceased individual.In layman’s language : man age 30 years retires at 60 years he would be working for another (60-30)30 years. Then

Earning per year : 6,00,000

Taxes and other expenses : 2,50,000

Net annual contribution to family : 3,50,000

Bank FD : 8%

Then his value will be (350000*100/8): 43,75,000

He should have insurance for 43,75,000 Sum Assured so that his liability will be covered.

In other words imagine one is driving a car. A drunk driver knocks that car. One become permanently disabled. Now one has to hire a lawyer to take legal action on the drunken driver. How much one can claim against his disability? It is his human life value.

c)SOCIAL CONCEPT:

Insurance has developed from the concept of sharing.In a village there are 400 houses, each valued at Rs.20,000. Every year, on an average, 4 houses get burnt, resulting into a total loss of Rs.80,000. If all the owners come together and contribute Rs.200 each, the common fund would be Rs.80,000. This is enough to pay Rs.20,000 to each of the 4 owners whose houses got burnt. Thus, the risk of 4 owners is spread over 400 house-owners of the village.

LIC OF INDIA ANNUAL REPORT 2014-2015 : Number of policy inforce individual 27,76,81,768 total Sum Assured 3506546.19 crore Total Premium 170840.61 crore.

These excludes group insurance and ulip plan.

Where as the sharing concept is concern isn't LIC OF INDIA THE BEST?

d)LIFE RISK COVER CONCEPT: (if investment is the only purpose please do not invest in Insurance Sector )

Life Insurance is the key to good financial planning. On one hand, it safeguards your money and on the other, ensures its growth, thus providing you with complete financial well being. Life Insurance can be termed as an agreement between the policy owner and the insurer, where the insurer for a consideration agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness, critical illness or maturity of the policy.

e)TAX REBATE CONCEPT:

Life Insurance Premium- Eligible Amount & Deduction

Life Insurance Plans are very popular as a tool to get deduction u/s 80C of the I T Act. 1. The investment in life insurance can be deducted up to Rs 1,50,000.

Tax Information – FY 2015 – 2016

India Income tax slabs 2015-2016 for General tax payers and Women

S. No. Income tax slab (in Rs.) Tax percentage

1 0 to 2,50,000 No tax

2 2,50,001 to 5,00,000 10%

3 5,00,001 to 10,00,000 20%

4 Above 10,00,000 30%

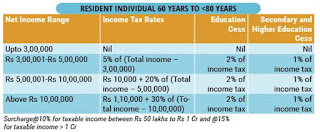

India Income tax slabs 2015-2016 – for Senior citizens (Aged 60 years but less than 80 years)

S. No. Income tax slab (in Rs.) Tax percentage

1 0 to 3,00,000 No tax

2 3,00,001 to 5,00,000 10%

3 5,00,001 to 10,00,000 20%

4 Above 10,00,000 30%

India Income tax slabs 2015-2016 – for Very Senior citizens (Above 80 years)

S. No. Income tax slab (in Rs.) Tax percentage

1 0 to 5,00,000 No tax

2 5,00,001 to 10,00,000 20%

3 Above 10,00,000 30%

f)INVESTMENT CONCEPT :

Usain Bolt has won 9 gold medals in last 3 Olympics and he has run less than 2 mins on the track. That's economy of effort.

Usain Bolt ran for less than 115 secs in total in his 3 Olympics career and made 119 million dollars!

That's more than $1M for each second he ran!

That's a new unit of speed for the "run" for money...

$ 1Million/sec

But for those 2 mins he trained for 25+ years !

That's investment

More than providing peace of mind your family and yourself, life insurance can be one of the best investment decisions you have ever made. With stringent regulatory conditions to safeguard policyholders, traditional life insurance policies carry minimum investment risk and provide long-term insurance benefits.

Most life insurance policies include retirement income on maturity.

Another advantage of life insurance is that the coverage amount can be increased over time. So, while presently, you can afford only a low insurance premium with your current salary, over time with increasing income through promotions or new income sources, you can increase your insurance cover by paying slightly higher premiums for your life insurance policy and provide a better life cover for your family even when you are not around.

While choosing a life insurance policy, it is generally advisable to look at various products that different organizations provide. Many insurance companies offer an array of insurance plans that best suit the needs of the entire family.

It is always better to invest your hard earned savings which will provide you with long-term benefits than to seek short-term benefits from high-risk investment ventures. Whether you have just started your career, are recently married or blessed with a family, securing adequate life insurance can prove to be the best investment decision you ever made.The effect of early investment as follows:

bank locker :

Locker Annual Rentals of Axis Bank (In Rs.)

Branch Category/Size-----Small-----Medium-----Large-----Extra Large

Metro/Urban---------------3000-------6000------10000-------12000

Semi-Urban----------------1700-------2500-------5500-------11000

Rural---------------------1500-------2200-------5000-------10000

Effective from 1st April'15.

Our life is more precious than lockers can we secure by taking Life Insurance Policy.

g)Insurance is a part of financial planning:

All of us have heard of the story "Alice in wonderland"remember that part of the story where the cat tells Alice "If you walk long enough, you will surely get somewhere". In the absence of financial planning , this is what could exactly happen.One may get somewhere in life but not necessarily to the desired destination.

Financial planning is the process of achieving financial goal through enhancement of existing financial resources with the help of financial tools.it is defined as the process of doing things in an orderly way to achieve the financial goals within a fixed time frame.The key areas of financial planning are:

1.Insurance Planning: life insurance/health insurance

2.Investment Planning

3.Tax Planning

4.Retirement Planning

5.Estate planning

Benefits Insurance Plan:

Normal death: Sum assured with vested bonuses if any

Accidental death: Sum Assured + Sum Assured with vested bonuses if any

Permanent disability:

1.Sum assured *10% for 10 years will be given to the policy holder

2.Premium will be waived off

3.Maturity Sum Assured + Bonus + FAB if any

Term rider:

Critical Illness Rider: Critical Illness it is not available with LIC PRODUCTS NOW

1. Cancer

2. Coronary Artery Disease

3. Coronary Artery bypass surgery

4. Heart valve surgery

5. Surgery to Aorta

6. Stroke

7. Kidney Failure

8. End Stage Lung Disease

9. End Stage Liver Failure

10. Coma

11. Multiple Sclerosis

12. Motor Neurone Disease

Why LIC OF INDIA ?

37.Policies to be Guaranteed by Central Government:

The sums assured of all policies issued by the Corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14, the amount assured by all policies issued by any insurer the liabilities which have vested in the Corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed, They shall be guaranteed as to payment in cash by the Central Government.

28.Surplus from life insurance business how to be utilized:

If as a result of any investigation undertaken by the corporation under section 26 any surplus emerges, ninety five percentage of such surplus or such higher percentage there of as the Central Government may approve, shall be allocated to or reserved for the life insurance policy holders of the Corporation, if any, which may arise under section 9, remainder shall be paid to the Central Government or, if that Government so directs, be utilized for such purposes and in such manner as that Government may determine.